low risk closed end funds

Hedge funds non-traded REITs and private placements. Closed-end funds have a fixed number of shares outstanding and in that respect are very different from open-end funds and exchange-traded funds.

Closed End Funds From All Angles

A closed-end fund CEF is a type of mutual fund where investors pool their money and a professional money management team oversees the portfolio by selecting the underlying.

. A closed-end fund or CEF is an investment company that is managed by an investment firm. A closed end fund is just like a mutual fund or an exchange traded fund in that a manager buys and sells investments and investors can buy an ownership stake in the whole. Some closed-ends are good.

Capital does not flow into or out of the funds when shareholders buy or sell. Closed-end funds raise a certain amount of money through an initial public. Closed-end funds come in many shapes and sizes but most CEFs are income-oriented.

But an asset class that has been around since 1893 offers a compelling combination of low risk and high income. Buy CEFs at larger than normal discounts to NAV and sell them when the discounts. George uses the following investment strategies1 Opportunistic Closed-end fund investing.

This is a much. A fund with 899 coverage will be excluded from the rankings whereas funds with 901 coverage will be considered even though only a sliver of difference separates the two. BlackRock Enhanced Capital and Income.

Without further ado here are 5 closed-end funds that I think are worth buying when they are trading at a bigger-than-normal discount to NAV. Several CEFs deliver yields anywhere between 6 to more than 9 while using little to no debt to juice their returns and I want to show you five of these funds today. This represents a 20 discount and the dividend which started at 7 cents and was originally a 7 yield is now providing a yield of 875 070 800 875.

Certain closed-end funds may invest without limitation in illiquid or less liquid investments or investments in which no secondary market is readily available or which are otherwise illiquid. Municipal bond closed-end funds were among the first and since have. Closed-end funds are a type of investment company whose shares are traded in the open market like a stock or ETF.

Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds.

Cfa Level I Mutal Funds And Exchange Traded Funds Etfs Video Lecture By Mr Arif Irfanullah Youtube

Retirees Seeking Income May Want To Consider Closed End Funds

High Return Low Risk Investment Combining Market Timing Stock Selection And Closed End Funds 0399126422 Hardcover Used Walmart Com

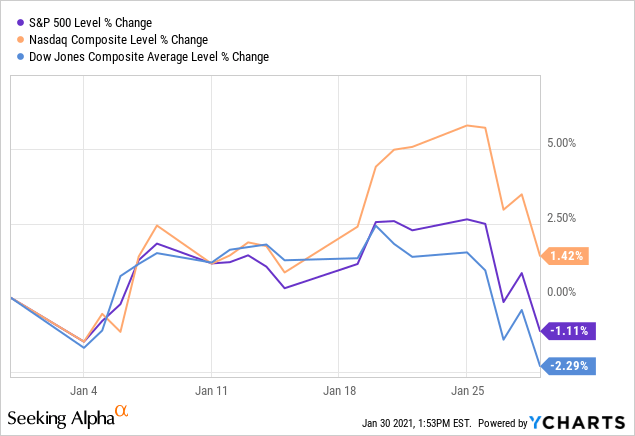

5 Closed End Fund Buys To Get The Income Snowball Rolling For 2021 Seeking Alpha

Lesson 4 Investment Companies Flashcards Quizlet

The Advantages And Risks Of Closed End Funds Aaii

:max_bytes(150000):strip_icc()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

How A Closed End Fund Works And Differs From An Open End Fund

Want Income Closed End Funds Offer Yield But Beware Of The Risks Stock News Stock Market Analysis Ibd

The 10 Best Closed End Funds Cefs For 2022 Kiplinger

Sommers Financial Management Cef Arbitrage Youtube

What Are Mutual Funds 365 Financial Analyst

13 Investing In Mutual Funds Mutual Fund An Investment Vehicle Offered By Investment Companies To Those Who Wish To Pool Money Buy Stocks Bonds Ppt Download

7 Worst Buys In Closed End Funds

The 10 Best Closed End Funds Cefs For 2022 Kiplinger

Closed End Funds Investment Guide Blackrock

What Is A Closed End Fund And Should You Invest In One Nerdwallet

Emerging Market Closed End Funds List Emerging Market Skeptic